When it comes to cashing checks, many people assume that presenting a valid ID is an absolute necessity. However, there are situations where individuals may need to cash checks without ID. Whether due to lost documents, being a foreigner, or other reasons, the concept of cashing checks without identification has become increasingly relevant in today's financial landscape.

Cashing a check without an ID might seem like a challenging task, but it is not impossible. This article aims to provide a detailed guide on how to navigate this process effectively. By understanding the various methods and alternatives available, individuals can ensure they access their funds without unnecessary complications.

As we delve deeper into the topic, we will explore the legalities, risks, and practical steps involved in cashing checks without identification. This guide is designed to empower readers with the knowledge they need to make informed decisions about their financial transactions.

Read also:Hdhub4u Gujarati Movies Your Ultimate Guide To Entertainment

Table of Contents

- Understanding Cash Check No ID

- Legal Aspects of Cashing Checks Without ID

- Methods to Cash Checks Without ID

- Alternative Solutions

- Risks Involved

- Tips for Safe Transactions

- Statistical Insights

- Expert Advice

- Building Trust in Financial Transactions

- Conclusion and Next Steps

Understanding Cash Check No ID

What is a Cash Check?

A cash check is a financial instrument issued by an individual or organization to transfer money to another party. It is typically presented at a bank or check-cashing service to withdraw funds. Traditionally, cashing a check requires the presentation of a valid ID to verify the identity of the person cashing it.

However, there are scenarios where individuals may not have access to an ID. This could be due to loss, theft, or simply not carrying one. Understanding the concept of cashing checks without ID is crucial for those who find themselves in such situations.

Why Cash Checks Without ID?

There are various reasons why someone might need to cash a check without ID. For instance, immigrants or travelers may not have access to local identification documents. Similarly, individuals who have misplaced their IDs or are in urgent need of funds might seek alternative methods to access their money.

This section will explore the common reasons and provide insights into how these situations can be managed effectively.

Legal Aspects of Cashing Checks Without ID

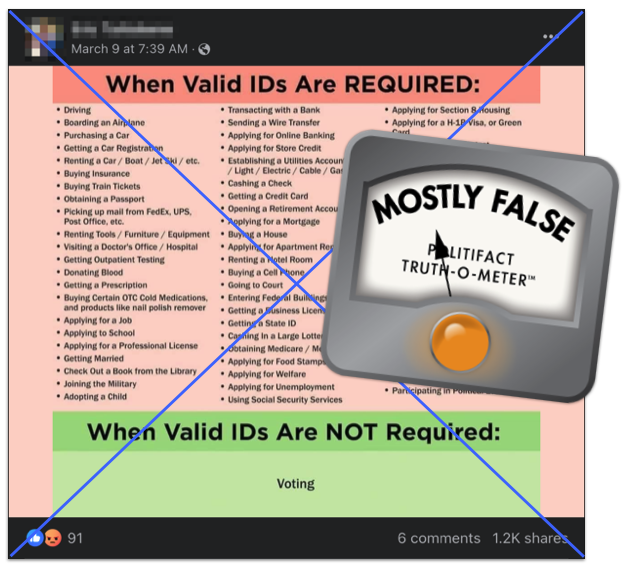

From a legal perspective, cashing checks without ID is not explicitly prohibited. However, financial institutions and check-cashing services have their own policies and procedures to ensure compliance with anti-money laundering (AML) regulations. These regulations are designed to prevent fraudulent activities and protect both the institution and the individual.

It is essential to understand the legal framework surrounding cash checks and the potential implications of cashing them without identification. This knowledge can help individuals navigate the process more confidently.

Read also:Lorena Bobbitt Case Summary A Deep Dive Into The Infamous Legal Battle

Regulations and Compliance

Financial institutions must adhere to strict regulations set by governing bodies such as the Financial Crimes Enforcement Network (FinCEN) in the United States. These regulations require institutions to verify the identity of individuals conducting financial transactions above a certain threshold.

- Know Your Customer (KYC) policies

- Anti-Money Laundering (AML) regulations

- Banks Secrecy Act (BSA) compliance

Methods to Cash Checks Without ID

Using Trusted Financial Institutions

Some banks and credit unions offer services that allow individuals to cash checks without presenting an ID. These institutions often rely on other forms of verification, such as account history or fingerprint scanning, to confirm the identity of the individual.

Researching and identifying such institutions can significantly simplify the process of cashing checks without ID.

Check-Cashing Services

Several check-cashing services cater to individuals who do not have access to traditional banking services. These services may require alternative forms of identification or rely on digital verification methods to ensure compliance with regulations.

It is important to choose reputable services to minimize risks and ensure a smooth transaction process.

Alternative Solutions

Mobile Banking Apps

With the rise of digital banking, mobile apps have become a popular alternative for cashing checks. Many banks offer mobile check deposit services that allow users to deposit checks directly from their smartphones. While these services typically require an account, they can be a convenient option for individuals without physical IDs.

Prepaid Debit Cards

Prepaid debit cards are another viable alternative for cashing checks without ID. These cards can be loaded with funds directly from checks and used for various transactions. They offer flexibility and convenience, making them a popular choice among unbanked individuals.

Risks Involved

Cashing checks without ID comes with certain risks that individuals should be aware of. These risks include the potential for fraud, identity theft, and financial loss. Understanding these risks is crucial for making informed decisions and taking appropriate precautions.

Preventing Fraud

Fraudulent activities are a significant concern when cashing checks without ID. To mitigate this risk, individuals should:

- Only use trusted financial institutions or services

- Verify the authenticity of the check before cashing it

- Be cautious of unsolicited offers or deals that seem too good to be true

Tips for Safe Transactions

To ensure safe and successful transactions when cashing checks without ID, consider the following tips:

- Keep all documents and records related to the transaction

- Verify the reputation of the financial institution or service provider

- Use secure and encrypted digital platforms for online transactions

By following these tips, individuals can minimize risks and protect their financial interests.

Statistical Insights

According to a report by the Federal Deposit Insurance Corporation (FDIC), approximately 5.4% of U.S. households are unbanked, meaning they do not have access to traditional banking services. This statistic highlights the need for alternative solutions for cashing checks without ID.

Additionally, a survey conducted by the National Check Fraud Center revealed that over 70% of check fraud cases involve checks cashed without proper identification. These statistics emphasize the importance of adopting safe practices when handling financial transactions.

Expert Advice

Financial experts recommend that individuals seeking to cash checks without ID should prioritize security and compliance. By working with reputable institutions and leveraging digital solutions, individuals can access their funds safely and efficiently.

Consulting with a financial advisor or legal expert can provide valuable insights and guidance tailored to specific circumstances.

Building Trust in Financial Transactions

Trust is a critical component of any financial transaction. To build trust, individuals should:

- Choose well-established financial institutions or services

- Maintain transparency in all dealings

- Stay informed about the latest trends and developments in the financial sector

By fostering trust, individuals can enhance their financial security and confidence in their transactions.

Conclusion and Next Steps

Cashing checks without ID is a feasible option for individuals who find themselves in unique situations. By understanding the methods, alternatives, and risks involved, individuals can navigate this process effectively and securely.

We encourage readers to share their experiences and insights in the comments section below. Additionally, exploring other articles on our website can provide further guidance on managing finances and navigating the complexities of the financial world.

Take the first step today and empower yourself with the knowledge and tools needed to manage your financial transactions confidently.