The Alaska Permanent Fund Dividend (PFD) is one of the most unique financial programs in the United States, offering residents a share of the state's oil wealth. This program has been a cornerstone of Alaska's economy and social welfare since its inception in 1982. For Alaskans, the PFD represents more than just a yearly payout; it symbolizes the collective ownership of the state's natural resources and serves as a safety net for individuals and families.

Understanding the intricacies of the PFD is essential for both current and prospective residents of Alaska. It provides valuable insights into how the state manages its resources and distributes wealth equitably among its population. In this article, we will delve into the history, mechanics, benefits, and challenges associated with the PFD, ensuring you have a comprehensive understanding of this remarkable program.

Whether you're a resident, a potential newcomer, or simply curious about Alaska's innovative approach to wealth distribution, this guide will equip you with all the necessary information. Let's explore the PFD and its significance in shaping Alaska's economic landscape.

Read also:Yoo Yeonseok The Rising Star In Korean Entertainment

Table of Contents

- The History of the Alaska Permanent Fund Dividend

- Eligibility Criteria for PFD

- How to Apply for the PFD

- Determining the PFD Amount

- Economic Impact of the PFD

- Social Benefits of the PFD

- Challenges Facing the PFD

- The Future of the PFD

- Frequently Asked Questions About the PFD

- Conclusion and Call to Action

The History of the Alaska Permanent Fund Dividend

The Alaska Permanent Fund Dividend (PFD) was established in 1980 when Governor Jay Hammond signed the Alaska Permanent Fund Corporation into law. This groundbreaking initiative aimed to ensure that future generations of Alaskans would benefit from the state's abundant oil resources. The fund was created using a portion of the state's oil revenues, which are invested in a diversified portfolio to generate long-term returns.

By 1982, the first PFD checks were distributed to eligible residents, marking the beginning of an annual tradition. Over the years, the PFD has grown significantly, with payouts ranging from a few hundred dollars to over two thousand dollars per person, depending on the fund's performance and legislative decisions.

Key Milestones in the PFD's History

- 1976: The Alaska Permanent Fund is established.

- 1980: The PFD program is created.

- 1982: First PFD checks are issued.

- 2008: The largest PFD payout to date, with each resident receiving $2,069.

Eligibility Criteria for PFD

To qualify for the Alaska Permanent Fund Dividend, applicants must meet specific criteria. These requirements ensure that only genuine residents of Alaska receive the benefit. The primary conditions include being an Alaska resident for a full calendar year, intending to remain a resident indefinitely, and not being absent from the state for more than 180 days during the eligibility period.

Additionally, certain legal exclusions apply, such as incarceration or residing in a medical facility outside Alaska. The Alaska Permanent Fund Corporation conducts thorough reviews to verify eligibility, ensuring the integrity of the program.

Residency Requirements

- Must have lived in Alaska for the entire year.

- Must intend to remain a resident of Alaska indefinitely.

- Cannot claim residency in another state or country.

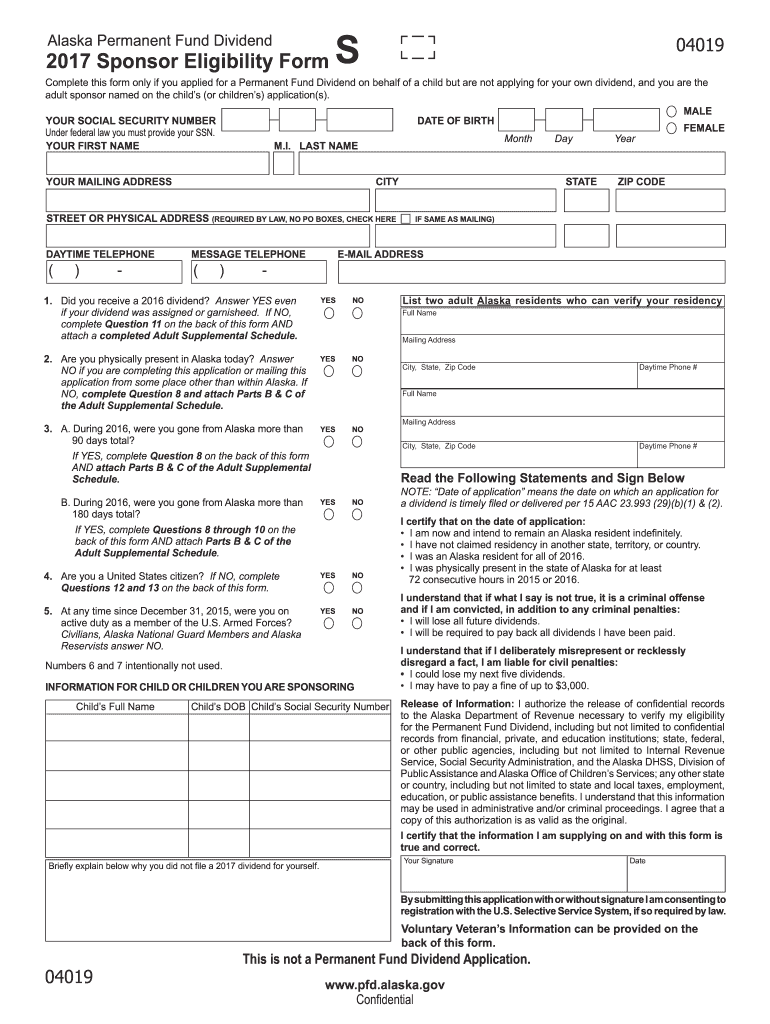

How to Apply for the PFD

Applying for the Alaska Permanent Fund Dividend is a straightforward process. Residents can apply online through the official Alaska Permanent Fund Corporation website. The application period typically opens in January and closes in March of each year. Applicants need to provide personal information, proof of residency, and financial disclosures as part of the application process.

For those who prefer a paper application, forms are available upon request. However, the online application is recommended for its convenience and faster processing times. Ensuring all required documentation is accurate and up-to-date is crucial to avoid delays or disqualification.

Read also:Oliver Simon Peter Blunt A Comprehensive Look Into His Life Achievements And Legacy

Determining the PFD Amount

The amount of the PFD varies each year based on the fund's earnings and legislative decisions. The formula used to calculate the dividend is straightforward: it takes the average earnings of the fund over the past five years and divides it by the total number of eligible residents. This ensures that the payout reflects the fund's financial health and sustainability.

In recent years, the PFD has ranged from approximately $1,000 to $2,000 per person. Factors such as oil prices, market performance, and state budgetary considerations can influence the final amount. Understanding the calculation process helps residents anticipate their potential payouts.

Factors Affecting PFD Payouts

- Oil prices and production levels.

- Investment returns of the Permanent Fund.

- State fiscal policies and legislative decisions.

Economic Impact of the PFD

The economic impact of the Alaska Permanent Fund Dividend is substantial. It injects millions of dollars into the local economy annually, boosting consumer spending and supporting small businesses. Studies have shown that the PFD contributes significantly to Alaska's GDP, with many residents using the funds for essential expenses, savings, and investments.

Moreover, the PFD acts as a stabilizing force during economic downturns, providing residents with financial security and reducing poverty rates. Its widespread distribution ensures that the benefits are felt across all socioeconomic groups, fostering economic equality.

Statistics on Economic Benefits

- Approximately $2 billion distributed annually to residents.

- Boosts local spending by an estimated 10-15% during payout months.

- Reduces poverty rates by providing a reliable source of income.

Social Benefits of the PFD

Beyond its economic advantages, the PFD offers numerous social benefits. It promotes financial literacy and encourages responsible financial management among residents. Many Alaskans use the dividend to invest in education, start businesses, or save for the future, enhancing their long-term well-being.

The PFD also fosters a sense of community and shared ownership of Alaska's natural resources. It serves as a reminder of the state's commitment to its residents and the importance of equitable wealth distribution. These social benefits contribute to a higher quality of life for Alaskans.

Examples of Social Impact

- Increased access to higher education through savings and investments.

- Empowerment of women and minority groups through financial independence.

- Enhanced community engagement and civic participation.

Challenges Facing the PFD

Despite its many benefits, the PFD faces several challenges that threaten its sustainability. Fluctuating oil prices and global market conditions can impact the fund's earnings, potentially reducing future payouts. Additionally, legislative debates over budget allocations and fund management can create uncertainty for residents.

Addressing these challenges requires careful planning and strategic decision-making. Ensuring the fund's long-term viability while maintaining its core mission of benefiting Alaskans is crucial for its continued success. Efforts to diversify the fund's investments and explore alternative revenue sources are underway to mitigate these risks.

The Future of the PFD

Looking ahead, the future of the Alaska Permanent Fund Dividend remains promising. Ongoing efforts to strengthen the fund's financial health and adapt to changing economic conditions are underway. Innovations in investment strategies and policy reforms aim to secure the program's sustainability for future generations.

As Alaska continues to evolve, the PFD will play an integral role in shaping the state's economic and social landscape. Its commitment to equitable wealth distribution and resident welfare ensures its relevance and importance in the years to come.

Frequently Asked Questions About the PFD

1. How often is the PFD distributed?

The PFD is distributed annually, typically in October.

2. Can non-residents receive the PFD?

No, only eligible Alaska residents can receive the PFD.

3. What happens if I miss the application deadline?

If you miss the deadline, you will not receive the PFD for that year. It's essential to apply within the specified timeframe.

Conclusion and Call to Action

The Alaska Permanent Fund Dividend represents a groundbreaking approach to wealth distribution and social welfare. Its impact on the state's economy and residents' lives is profound, offering financial security and promoting equality. Understanding the program's history, mechanics, and benefits is essential for appreciating its significance.

We encourage readers to explore the resources available through the Alaska Permanent Fund Corporation and stay informed about legislative developments affecting the PFD. Share your thoughts and experiences in the comments section below, and don't forget to explore other informative articles on our site. Together, let's celebrate and support this remarkable program that benefits all Alaskans.