Understanding the Colorado 1099-G tax refund is essential for anyone who has received government payments or refunds during the tax year. This document provides critical information about your tax obligations and helps ensure you file your taxes accurately. Whether you're a resident of Colorado or someone who has interacted with the state's tax system, knowing how to handle Form 1099-G is crucial for maintaining compliance and maximizing your refund potential.

Many taxpayers find themselves confused when they receive a 1099-G form in the mail. This confusion often stems from misunderstanding the purpose of the form and how it impacts your overall tax return. In this article, we will delve into the specifics of the Colorado 1099-G tax refund process, offering actionable insights and expert advice.

Our goal is to provide clarity and guidance so that you can navigate the complexities of tax filing with confidence. Whether you're a first-time filer or a seasoned taxpayer, this guide will be an invaluable resource for ensuring your tax returns are accurate and compliant with Colorado's tax laws.

Read also:Nina Totenberg Health A Comprehensive Look At The Iconic Journalists Wellbeing

Table of Contents

- What is Form 1099-G?

- Colorado 1099-G Overview

- Who Receives Form 1099-G?

- Filing Requirements for 1099-G

- The Tax Refund Process in Colorado

- Common Mistakes to Avoid

- How to File Your Colorado 1099-G Tax Refund

- Deductions and Credits Available

- Resources and Tools for Taxpayers

- Conclusion

What is Form 1099-G?

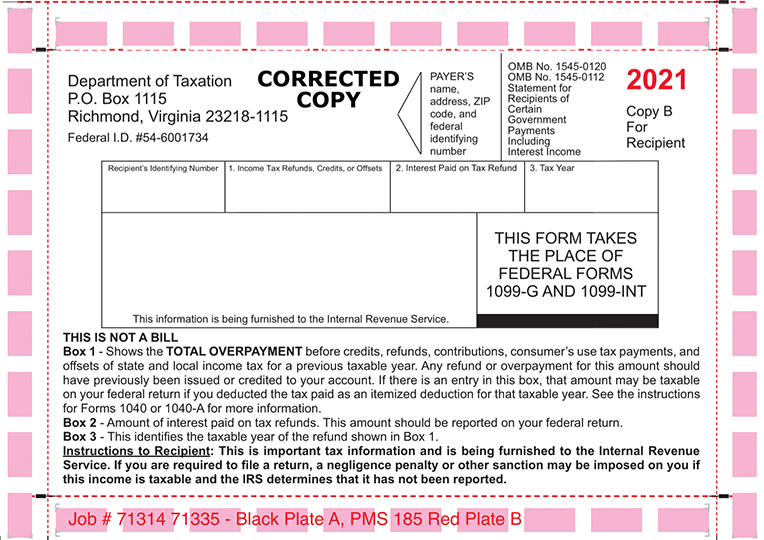

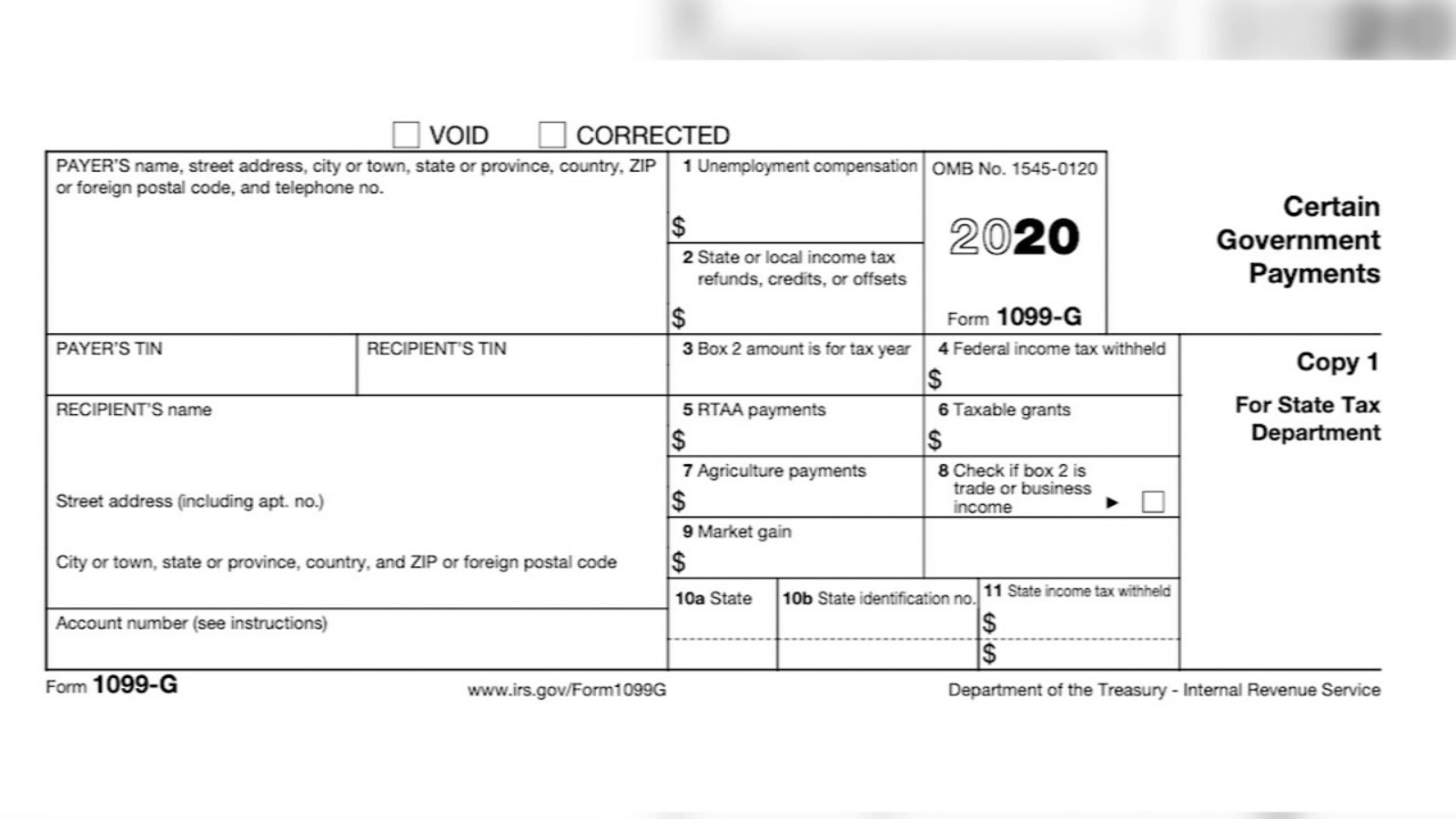

Form 1099-G is an IRS tax form used to report certain government payments made to individuals during the tax year. These payments may include unemployment compensation, state or local tax refunds, and other government-related income. The form serves as a record of these payments for both the taxpayer and the IRS, ensuring accurate reporting during tax season.

For taxpayers, Form 1099-G provides essential information that must be included when filing your federal and state tax returns. It helps ensure that any government payments you received are accounted for and properly reported to avoid potential penalties or discrepancies.

Key Components of Form 1099-G

Understanding the key components of Form 1099-G is crucial for accurate tax filing. Below are the main sections you will encounter:

- Box 1: Total Payments - This box shows the total amount of government payments you received during the tax year.

- Box 2: State Tax Refunds - This box indicates any state or local tax refunds you received, which may need to be reported as income.

- Box 3: Unemployment Compensation - This box reports any unemployment benefits you received, which are generally taxable.

Colorado 1099-G Overview

When it comes to Colorado's 1099-G tax refund process, residents must be aware of specific state regulations and requirements. The Colorado Department of Revenue issues Form 1099-G to taxpayers who have received certain payments from the state, such as tax refunds or unemployment benefits. These forms are typically sent by January 31st of each year.

Colorado-Specific Considerations

While the federal Form 1099-G serves as a general template, Colorado has its own unique requirements that taxpayers should be aware of:

- Colorado may require additional documentation or forms depending on the nature of the payments received.

- Taxpayers should verify whether their state tax refund is taxable at the federal level, as this can impact their overall tax liability.

Who Receives Form 1099-G?

Not every taxpayer will receive a Form 1099-G. This form is specifically issued to individuals who have received certain types of government payments during the tax year. Common recipients include:

Read also:Lebron James Mother The Untold Story Of Her Journey

- Individuals who received unemployment compensation.

- Taxpayers who received a state or local tax refund.

- Those who were awarded government grants or other forms of financial assistance.

It is important to note that not all government payments are reported on Form 1099-G. For example, social security benefits are reported on a different form (Form SSA-1099).

Filing Requirements for 1099-G

Once you receive Form 1099-G, it is essential to understand how it fits into your overall tax filing process. The information provided on this form must be accurately reported on your federal and state tax returns to ensure compliance.

Steps to Follow

Here are the key steps to follow when incorporating Form 1099-G into your tax filing:

- Verify the accuracy of the information provided on the form.

- Report the appropriate amounts on your federal tax return (Form 1040).

- Include the necessary information on your Colorado state tax return (Form DR 104).

The Tax Refund Process in Colorado

For many taxpayers, receiving a tax refund is one of the highlights of the year. However, understanding the process behind how refunds are calculated and issued is important for managing expectations and avoiding surprises. In Colorado, tax refunds are typically issued after the state processes your tax return and determines that you are owed money.

Factors Affecting Your Refund

Several factors can influence the size of your tax refund in Colorado:

- The amount of taxes you paid throughout the year via withholding or estimated payments.

- Any deductions or credits you claim on your tax return.

- Prior-year tax refunds that may need to be reported as income.

Common Mistakes to Avoid

When dealing with Form 1099-G and tax refunds, it's easy to make mistakes that could lead to penalties or delays. Below are some common errors to avoid:

- Forgetting to report state tax refunds as income on your federal return.

- Incorrectly calculating the taxable portion of unemployment compensation.

- Failing to verify the accuracy of the information provided on Form 1099-G.

By staying vigilant and double-checking your work, you can minimize the risk of errors and ensure a smoother tax filing experience.

How to File Your Colorado 1099-G Tax Refund

Filing your Colorado 1099-G tax refund involves several steps, including gathering necessary documents, completing the appropriate forms, and submitting them by the deadline. Here's a step-by-step guide to help you through the process:

Step 1: Gather Your Documents

Before beginning the filing process, ensure you have all the necessary documents, including:

- Form 1099-G

- W-2 forms from employers

- Previous year's tax return

Step 2: Complete Your Tax Return

Using the information from Form 1099-G and other relevant documents, complete your federal and state tax returns. Be sure to include any necessary adjustments or deductions.

Deductions and Credits Available

Colorado offers several deductions and credits that can help reduce your tax liability and increase your refund. Some of the most commonly used include:

- Homestead Exemption

- Child Tax Credit

- Earned Income Tax Credit (EITC)

Taking advantage of these opportunities can significantly impact your overall tax outcome, so it's worth exploring which ones you may qualify for.

Resources and Tools for Taxpayers

For taxpayers seeking additional guidance, there are numerous resources available to assist with understanding and filing Form 1099-G:

These resources provide detailed information and tools to help ensure accurate and compliant tax filing.

Conclusion

In conclusion, understanding the Colorado 1099-G tax refund process is vital for ensuring accurate tax filing and maximizing your refund potential. By following the steps outlined in this guide and utilizing available resources, you can navigate the complexities of tax season with confidence.

We encourage you to share this article with others who may find it helpful and to leave any questions or comments below. Additionally, explore our other articles for more insights into personal finance and tax planning. Together, we can empower you to take control of your financial future.