Peter Madoff, the younger brother of infamous Ponzi schemer Bernard Madoff, has been a central figure in one of the most notorious financial scandals in history. His net worth, or what remains of it, has been the subject of intense scrutiny. Understanding Peter Madoff's financial journey requires a deep dive into his involvement in Bernard Madoff Investment Securities (BMIS) and the legal consequences he faced.

Peter Madoff's name became synonymous with financial betrayal when the massive fraud orchestrated by his brother was uncovered in 2008. As the Chief Compliance Officer of BMIS, Peter held a significant role in the company, raising questions about his awareness of the fraudulent activities. This article aims to explore the financial journey of Peter Madoff, shedding light on his net worth before and after the scandal.

Through a detailed examination of Peter Madoff's involvement in BMIS, his legal battles, and the financial implications of the scandal, we will provide a comprehensive overview of his financial history. By the end of this article, you will have a clearer understanding of how his life and finances were transformed by one of the largest frauds in modern history.

Read also:Data Aries Sign Unveiling The Secrets Of The Zodiac

Table of Contents

- Biography of Peter Madoff

- Early Life and Education

- Career at BMIS

- Role in the Madoff Scandal

- Legal Consequences

- Peter Madoff Net Worth

- Assets Recovery Efforts

- Life After the Scandal

- Lessons Learned

- Conclusion

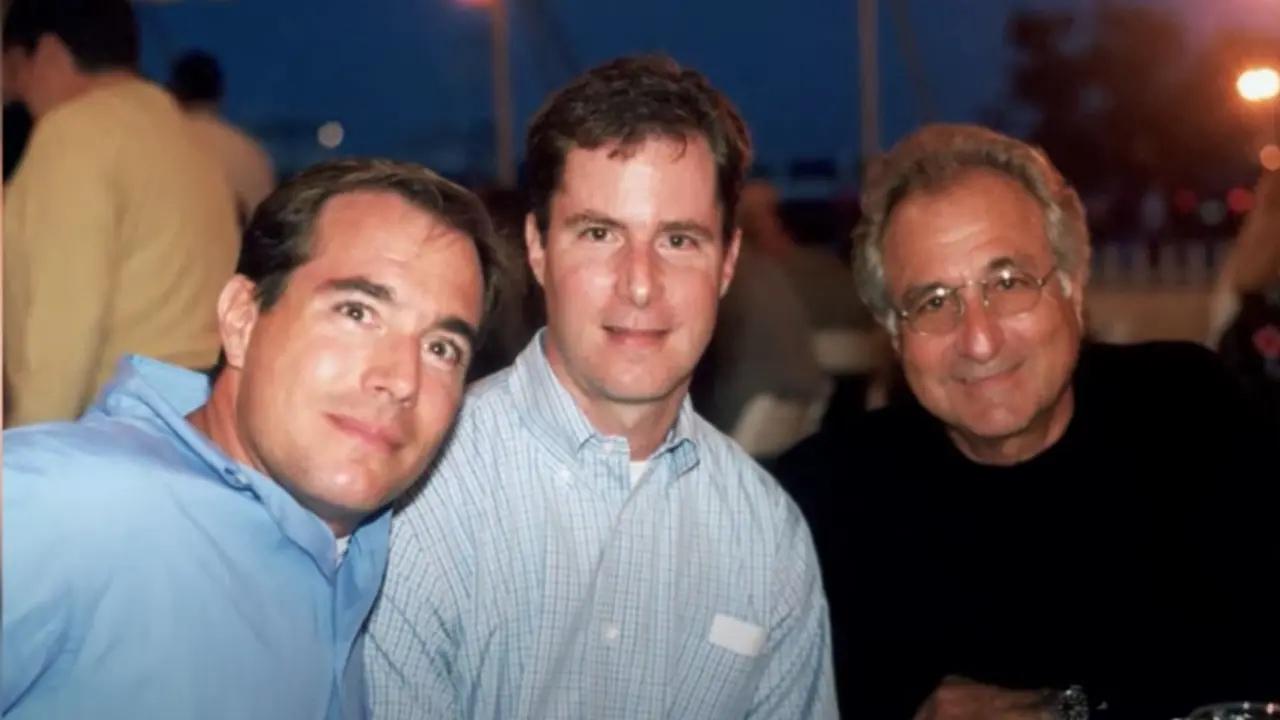

Biography of Peter Madoff

Peter Madoff, born on February 22, 1945, is an American businessman and former executive at Bernard Madoff Investment Securities (BMIS). His career was deeply intertwined with his brother Bernard Madoff's operations, making him a key figure in one of the largest financial frauds in history.

Data and Biodata of Peter Madoff

| Full Name | Peter Bernard Madoff |

|---|---|

| Date of Birth | February 22, 1945 |

| Place of Birth | Queens, New York, USA |

| Occupation | Former Chief Compliance Officer at BMIS |

| Notable Event | Involved in the Bernard Madoff Ponzi Scheme |

Early Life and Education

Peter Madoff grew up in a modest household in Queens, New York. His early life was marked by a strong family bond with his brother Bernard. Both brothers attended the same schools, laying the foundation for their future business partnership.

Peter pursued higher education, graduating from Hofstra University. Although he did not initially follow a traditional financial career path, his skills and connections eventually led him to join BMIS, where he played a pivotal role.

Career at BMIS

Peter Madoff's career at BMIS began in 1960 when he joined the firm as a part-time employee. Over the years, he climbed the ranks, eventually becoming the Chief Compliance Officer. His responsibilities included overseeing regulatory compliance and ensuring the firm adhered to financial regulations.

Despite his official title, questions have arisen about the extent of his involvement in the fraudulent activities that ultimately brought down BMIS. Critics argue that his position allowed him to turn a blind eye to the irregularities within the company.

Role in the Madoff Scandal

The Bernard Madoff Ponzi scheme, which collapsed in 2008, was one of the largest financial frauds in history. Peter Madoff's role in this scandal has been heavily debated. Prosecutors alleged that he was aware of the fraudulent activities and actively participated in them.

Read also:Susan Boyle 2024 A Journey Of Resilience And Talent

Key evidence against Peter included his involvement in falsifying financial records and facilitating the transfer of funds to conceal the scheme. His position as Chief Compliance Officer raised questions about his complicity in the fraud.

Legal Proceedings Against Peter Madoff

- Charged with securities fraud and conspiracy

- Sentenced to 10 years in federal prison in 2012

- Agreed to forfeit all his assets as part of the legal settlement

Legal Consequences

Peter Madoff's legal troubles began shortly after the scandal was uncovered. In 2012, he pleaded guilty to multiple charges, including securities fraud and conspiracy. As part of his plea agreement, he admitted to his role in the fraud and agreed to forfeit all his assets.

The legal consequences extended beyond incarceration. Peter's reputation was irreparably damaged, and he became a pariah in the financial community. His guilty plea was seen as a way to mitigate his sentence, but it did little to restore his credibility.

Peter Madoff Net Worth

Prior to the scandal, Peter Madoff's net worth was estimated to be in the tens of millions. However, the collapse of BMIS and the subsequent legal proceedings wiped out his wealth. As part of the settlement, he was required to forfeit all his assets, leaving him with virtually nothing.

Estimates suggest that Peter's net worth post-scandal is negligible. The recovery efforts led by the trustee overseeing the Madoff case have resulted in the return of billions of dollars to defrauded investors, further diminishing Peter's financial standing.

Factors Affecting Net Worth Decline

- Legal settlements and asset forfeiture

- Recovery efforts by the trustee

- Public backlash and loss of credibility

Assets Recovery Efforts

The trustee appointed to oversee the Madoff case, Irving Picard, has been instrumental in recovering assets for defrauded investors. Through legal actions and settlements, billions of dollars have been returned to victims of the Ponzi scheme.

Peter Madoff's assets were among those targeted for recovery. The trustee pursued legal actions against him and other family members to reclaim funds that were transferred out of BMIS before the scheme collapsed.

Life After the Scandal

Peter Madoff's life after the scandal has been marked by legal challenges and public condemnation. Following his release from prison in 2020 due to health reasons, he has largely remained out of the public eye. His once-prominent position in the financial world is now a distant memory.

The scandal not only affected Peter personally but also had a profound impact on his family. The Madoff name became synonymous with fraud, tarnishing the legacy of an entire family.

Lessons Learned

The Peter Madoff net worth scandal serves as a cautionary tale about the dangers of financial misconduct. Key lessons include:

- The importance of transparency and accountability in financial institutions

- The need for robust compliance frameworks

- The devastating consequences of fraudulent activities

Regulatory bodies have since implemented stricter measures to prevent similar frauds from occurring in the future. The Madoff scandal highlighted the vulnerabilities within the financial system and prompted reforms to protect investors.

Conclusion

Peter Madoff's financial journey is a complex narrative of rise and fall, shaped by one of the most infamous frauds in history. His net worth, once substantial, was obliterated by legal settlements and asset recoveries. The scandal not only impacted his personal life but also served as a wake-up call for the financial industry.

As we reflect on the lessons learned from this case, it is crucial to remain vigilant against financial misconduct. We invite you to share your thoughts in the comments section or explore other articles on our site to gain further insights into financial integrity and compliance.